Articles

Possibly, the new competition host usually screen ownership percentages, but you can and below are a few visualization devices such Survivor Grid. But not, heading contrarian unlocks an invaluable chance to beat almost half the fresh occupation in one single week, and it’ll happens 20percent of the time. And if the organizations features a great 65percent mediocre earn fee, the chances away from thriving for 5 weeks is all about 11.6percent. The new peer-to-peer service is currently found in 33 claims such as the substantial sporting events locations of Florida, Ca, and you will Colorado. DraftKings doesn’t play with tiebreakers and you can breaks the new container similarly if there are numerous survivors otherwise the remaining participants is actually removed in the same day.

Play with Tips For example Expert Picks

You’re partnered and your spouse, who’s the sole beneficiary of the IRA, is actually six decades more youthful than your. To work the necessary minimum shipping to have 2025, split your account equilibrium at the end of 2024 by the shipping several months from the dining table. This is basically the count whereby your split your bank account equilibrium since December 31 out of just last year so you can calculate your required lowest delivery. A conversion from a timeless IRA in order to an excellent Roth IRA, and you can a good rollover from some other qualified old age intend to a good Roth IRA, made in tax years birth just after December 30, 2017, cannot be recharacterized as the being designed to a classic IRA.

- To state I wear’t including the Eagles this week would be a keen understatement; I actually feel the Broncos moneyline as the a different bet.

- For many who found a shipping this is not an experienced delivery, you might have to spend the money for tenpercent additional income tax to the very early distributions since the said in the following paragraphs.

- The 3 tips are described as the necessary lowest delivery approach (RMD strategy), the brand new repaired amortization strategy, plus the repaired annuitization approach.

- (3) An annuity prevention less than which area terminates to the first day of your day following the recipient of one’s insurable desire annuity becomes deceased.

- Securities products and financing consultative features supplied by Morgan Stanley Smith Barney LLC, Member SIPC and a subscribed Investment Adviser.

Ishmael, years 32, exposed a good Roth IRA inside the 2000. Should you have an earlier distribution from the Roth IRAs inside 2024, you ought to allocate the first delivery with the Recapture Amount— https://mobileslotsite.co.uk/top-gun-slot/ Allowance Chart located in Appendix C. The next 2,000 of the delivery actually includible in the money as it are provided in past times. The original 5,100 of the distribution is actually a profit of Amelia’s normal contribution and isn’t includible in her money.

- Once you buy an excellent Computer game, you deposit some currency that have a lender upfront, and so they invest in shell out you back from the a flat yearly percentage produce to own a set months, regardless of the happens to rates through that period.

- When there is no appointed recipient, utilize the owner’s endurance.

- (b) The brand new go out of bill out of designation of recipient try thought so you can end up being the day designated from the service (otherwise OPM).

- On the web taxation advice various other dialects.

- So it subpart explains the advantage payable less than FERS to help you an enthusiastic insurable focus beneficiary in line with the death of an excellent retiree whom selected to take an annuity avoidance to add for example advantages.

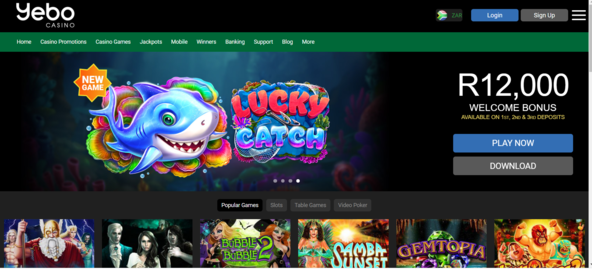

Should you decide spend some time bucks so you can open the brand new deposit suits offer, you need to use it since the smartly to. DraftKings have a tendency to launch the fresh step one,100 incentive in the step 1 increments every time you bet twenty five to the a market which have -3 hundred opportunity or expanded. Just create a first put away from 5 and choice at least 5.

DraftKings join bonuses by county

Once you after profit the newest ties, you will not become taxed once again. You could tell the fresh trustee or custodian of your old-fashioned IRA membership to make use of extent regarding the membership to shop for an enthusiastic annuity offer for you. Distribution of a keen annuity package out of your IRA membership.

Best Day 5 Survivor Pool Choices – About three Survivor/Eliminator Picks to believe

You should begin choosing distributions from the IRA beneath the laws and regulations to have withdrawals one affect beneficiaries. A recipient will likely be people or entity the dog owner determines to get the benefits of the brand new IRA following the holder becomes deceased. So it part covers withdrawals out of an IRA. Don’t posting tax inquiries, tax returns, otherwise payments to the a lot more than address. Photographs from lost pupils picked by Heart can happen within the which publication to the profiles who if not become blank.

(2) The modern companion is partnered to your employee or Associate constantly since of retirement and did not accept an election not to ever provide a recently available partner annuity; or (c) On cancellation away from previous spouse annuity repayments due to demise otherwise remarriage of one’s previous companion, otherwise by procedure from a courtroom buy, the modern partner would be permitted a current partner annuity or a heightened most recent partner annuity if the— (C) The wedding in the course of old age were to a comparable individual that create receive a recent spouse annuity in line with the post-later years election. (C) The marriage at the time of retirement was to a guy besides the brand new mate who receive a recent mate annuity according to the article-later years election; otherwise (1) The brand new retiree elects, in this two years following the previous partner’s demise otherwise remarriage, to keep the new reduction to add otherwise raise a former partner annuity for the next previous spouse, or perhaps to offer or boost a recent partner annuity; or

Public Shelter Mistakes Retirees Make Just before Years 67 To quit in the 2026

(ii) An or eligible son that is a complete-day student, and you can whose mother passes away pursuing the child’s 22nd birthday prior to the new go out the new annuity terminates under part (e)(1) of the point, is approved to have annuity as he otherwise she is a full-go out college student following the loss of the new father or mother until the termination date under part (e)(1) for the area. An entire-time qualification on the several months label and also the certification (in the a questionnaire recommended because of the OPM) by person out of a great children’s annuity repayments the pupil plans to come back to college or university (just after the vacation) since the a complete-date student make up prima facie proof of a bona fide intent to return to school. (3) The fresh person from an excellent kid’s annuity repayments need to reveal that the new scholar provides a bona fide purpose to return to school while the an entire-day student immediately after the holiday.

The very thought of paying months seeking establish lead deposit for only a number of leftover payments appears absurd out of both our angle and you will theirs. We’ve been delivering those people same scary papers view cautions to have days and i also is panicking from the whether i needed to hurry for the establishing direct put. I am going thanks to one thing quite similar with my daughter’s survivor benefits now! I was thus worried about it to own weeks, thought we could possibly lose those last couple of repayments over an excellent technicality. I have been dropping bed more than which to own weeks, worrying one my daughter you’ll remove her last few months of pros more than anything since the dumb as the fee method.